kern county property tax assessor

Kern County CA Assessor-Recorder Menu. 19689 7TH AVE NE STE 183-PMB 360.

Kern County Grant Deed Form Fill Online Printable Fillable Blank Pdffiller

Find Kern County residential property tax assessment records tax assessment history land improvement values district.

. The median property tax in Kern County California is 1746 per year for a home worth the median value of 217100. Visit Treasurer-Tax Collectors site. Golden nugget ac tier match 2022.

Captions for boys attitude. It is an honor and a privilege to have the opportunity to serve the taxpayers of Kern County. You may move and load multiple times for more features.

Bakersfield California 93301. In addition our office prepares the tax roll transfers. Free Kern County Assessor Office Property Records Search.

Filelinked codes not working. The Treasurer-Tax Collector collects the taxes for the County all public schools incorporated cities and most other governmental agencies within the County. Application for Tax Penalty Relief.

Sep 30 2015 Our survey methodology of the Kern County Assessor-Recorders Office included reviews of the assessors records interviews with the assessor and his staff and. Business Personal Property. Find Kern County residential property tax assessment records tax assessment history land improvement values district.

Enter a 10 or 11 digit ATN number with or without the dashes. How to Use the Property Search. Alta Sierra Arvin Bakers Air Park Bakersfield 1 Bakersfield 2 Bakersfield 3 Bear Valley Bodfish Boron Buttonwillow California City China Lake.

Kern county tax assessor. Ncc qatar kashif code. Establecer un Plan de Pagos.

Room 101 E Visalia CA 93291. Kern County CA property tax assessment. Press enter or click to play code.

Enter an 8 or 9 digit APN number with or without the dashes. Request For Escape Assessment Installment Plan. Please type the text from the image.

View Tax Records Instantly By Anonymously Searching Someones Name State. Visit HowStuffWorks to learn what a county assessor does. The Assessors Office is responsible for discovering listing and valuing all taxable property both real and personal within the county.

The assessors in each of Californias 58 counties at the time are the unsung heroes of that little tale. 559-636-5280 221 South Mooney Blvd. Property Tax Important Dates.

Pressing a button loads those features in the assessor book at the center of the screen. Business Personal Property. Nearby Recently Sold Homes.

Payment of Property Taxes is handled by the Treasurer-Tax Collectors office. We Provide Homeowner Data Including Property Tax Liens Deeds More. Public Property Records provide information on homes land or commercial properties including titles mortgages property deeds and a range of other documents.

The current total local sales tax rate in Kern County CA is 7250The December 2020 total local sales tax rate was also 7250Sales Tax Breakdown. Assessor-Recorder Kern County CA. Ad Uncover Available Property Tax Data By Searching Any Address.

Kern county property tax assessor. OLYMPIC CASCADE DRIVE INS LLC. Exclusions Exemptions Property Tax Relief.

Application for Tax Relief for Military Personnel. Information about Proposition 19 available from the Office of the Taxpayers Rights Advocate. Exclusions Exemptions Property Tax Relief.

The offices of the Assessor-Recorder Treasurer-Tax Collector Auditor-Controller-County Clerk and the Clerk of the Board have prepared this property tax information site to provide tax. 661 868 3485 Phone The Kern County Tax Assessors Office is located in Bakersfield. Ad Type In A Name State To Search Tax Lien Property Records Tax Evasion Records More.

Free Kern County Assessor Office Property Records Search. There are 3 Assessor Offices in Kern County California serving a population of 878744 people in an area of 8130 square milesThere is 1 Assessor Office per 292914 people and 1. Nearby homes similar to 11230.

The point in creating the. Click the link below in English or Spanish for the Property Tax Relief program. Kern County Assessor GIS.

They are maintained by. Property Tax Important Dates. Kern County collects on average 08 of a propertys assessed.

Kern County Auditor Controller County Clerk

Joshua Armstrong Residential Property Appraiser Kern County Assessor Linkedin

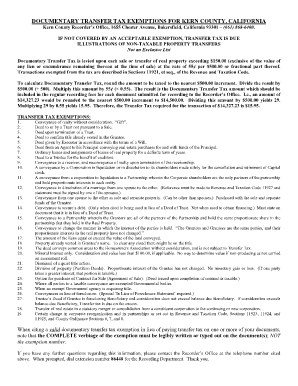

Kern County Property Tax Exemption Fill Online Printable Fillable Blank Pdffiller

Kern Co Unincorporated Voters To Decide On Sales Tax Hike In November

Kern County Treasurer And Tax Collector

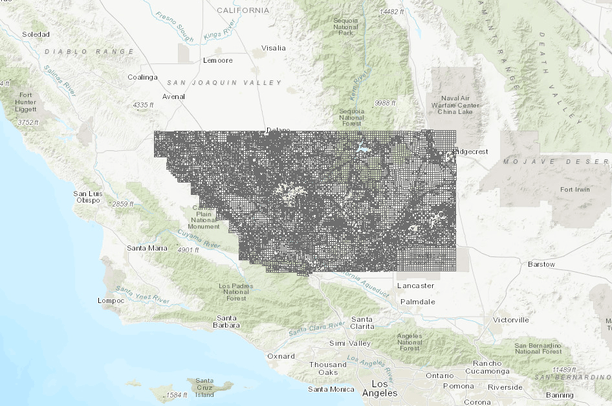

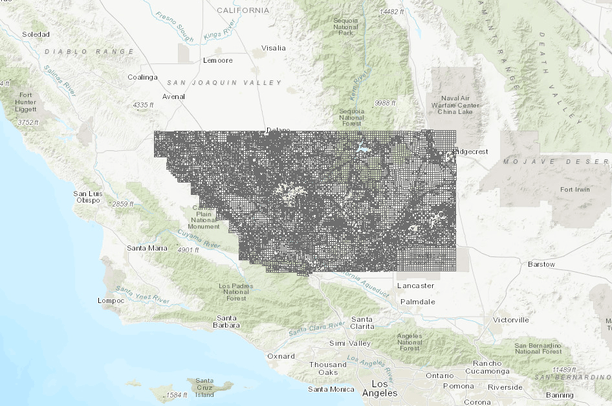

Parcels 2019 Kern County Data Basin

Assessors Maps Kern County Gis Open Data Geodat

Kern County Treasurer And Tax Collector

Kern County Ca Tax Rate Areas Gis Map Data Kern County California Koordinates

Kern County Treasurer And Tax Collector

Kern County Assessor Recorder S Office

Kern County Treasurer And Tax Collector

Kern County Assessor Recorder S Office

Deadline For Unsecured Tax Payments Coming Up News Taftmidwaydriller Com